The Origin of Money

Going back many millenia, to the days when civilization was in its infancy, there originally was no “money” being spent. Everything originally was bartered, trading goods and services for other goods and services. Problems arose from this, as sometimes the goods or services one person had to offer weren't necessarily wanted or needed by the other party. It was also impractical to carry some goods (Ex: Cattle) everywhere in order to trade for something. A better system was needed that would be universally valued. It needed to be something rare, that the average person couldn't gather themselves. It also needed to be durable and impervious to corrosion, the elements and regular handling. This is a role gold and silver filled perfectly.

(Created with Bing)

(Created with Bing)

The average person couldn't just go into a field or the hills, dig a hole and pull out gold or silver. Gold and silver were certainly rare. They also are impervious to rust, corrosion and fire. They also have an eye appeal other metals and materials don't possess. Because of this the world agreed both metals have inherent value. By adopting gold and silver as money, it became easier for commerce to happen locally and worldwide. If someone offered a good or service but didn't have a good or service that was wanted, they could instead pay with gold or silver. The person being paid could then find someone with the good or service they want and pay them with their newly-acquired gold or silver.

The Introdution of Paper Notes

As civilization progressed, many nations began introducing paper notes. These were redeemable at any time for their equivalent of gold or silver. While not as durable as the metals themselves, it was much more convenient to carry larger sums of money and travel lightly.

Paper Notes Become Worthless

Eventually many countries stopped backing their paper notes with anything. If you wanted to redeem the notes with the government or bank for gold and silver, you would be denied. These notes became an IOU from the government, but wasn't redeemable for anything. So long as everyone had confidence in the paper notes, they could at least be redeemed for goods and services. If confidence were to erode, however, then the paper was worthless and people rushed to convert it into anything useful: food, commodities, tools, real estate, land, cattle, etc.

Inflation Begins

The problem with this situation is that since the paper notes aren't backed by anything, nations could print as much as they wanted. You then had inflation caused by too many paper notes being offered to pay for far fewer goods and services. People and businesses started to realize the paper notes aren't worth what they were and began to charge more for the same goods and services as they realized their own paper notes weren't covering the bills and purchasing as much as they did in the past.

Nations and Banks Still Hold Gold and Silver

If you pay attention to the news and government/bank reports, you'll notice they're all still buying gold and silver. Very few are selling, as the vast majority continue purchasing and holding what they have. Why? Because gold and silver have always been “top tier assets” that are much more liquid than real estate, land and other commodities. These assets keep their value through times of economic uncertainty. They are what will preserve your wealth regardless of what my happen in the future. It's never too late to start storing some of your wealth in gold and silver as a form of savings and preparation for possible uncertain times in the future.

Buy DUO and stake to receive Hive dividends, tip others, have your posts curated and grow Hive!

https://tribaldex.com/trade/DUO

https://hive-engine.com/trade/DUO

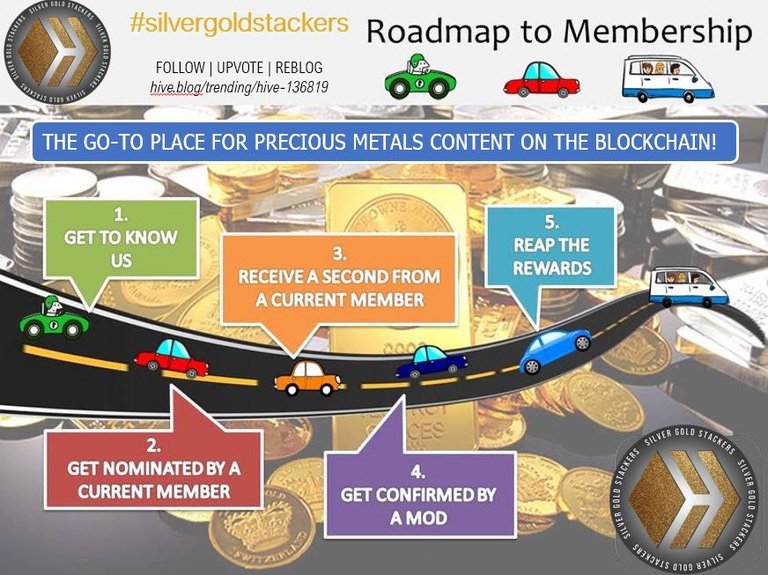

Do you like stacking gold and silver?

Are you new to Hive, or know someone new to Hive, and want help and support?

Have you been on Hive for a while and want to help new Hive members? Join HOC and help us grow Hive and encourage new members!

!hiqvote

You received an upvote of 82% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Congratulations @bulliontools! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI wonder if my country has any gold or silver 😔

It was only a few years ago that the Bank of International settlements, BIS, declaring gold as a Tier ONE Asset, Fast forward today, gold has now the dominant reserve.

The progression continues with us here on hive , the pinnacle of free banking !DOOK !LOL

You just got DOOKed!

@bitcoinman thinks your content is the shit.

They have 10/400 DOOK left to drop today.

Learn all about this shit in the toilet paper! 💩

lolztoken.com

Nobody nose.

Credit: mimismartypants

@bulliontools, I sent you an $LOLZ on behalf of bitcoinman

(2/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

@bulliontools, the HiQ Smart Bot has recognized your request (1/3) and will start the voting trail.

In addition, @bulliontools gets !PIZZA from @hiq.redaktion.

For further questions, check out https://hiq-hive.com or join our Discord. And don't forget to vote HiQs fucking Witness! 😻

According to Yuval Noah Harari in "Sapiens: A Brief History of Humankind" (I recommend this book), money is an illusion that works because people believe in it, and I think the same is true of crypto-currencies, precious metals are anything but an illusion.

!LOLZ

lolztoken.com

There, their, they're.

Credit: reddit

@bulliontools, I sent you an $LOLZ on behalf of servelle

(4/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

Peace

Money management against the people is cruel

Thank you for this informative article

@oadissin

Regards

Yes, it's a trap designed to keep us debt slaves our whole life

You're welcome 🙂

"Origin o' 'bunsens' ye means!" 😄 -Keptin

I don't know what "bunsens" are, but I won't say no to treasure! 😁

We never should have left the gold standard, but Nixon took it away and now where are we? Nowhere pretty...

Yeah, it was a terrible move and we're constantly paying the price for it

And we will continue too... Nixon shouldn't have caved to the pressure from corporations who benefit from inflation...