Mental gymnastics: Making sense of the profits and losses in the Hive's layer 2 tokens

Let's do some mental gymnastics!

I am an investor in WORKERBEE. All of those I owned are staked to earn BEE. To read about why I invested in WORKERBEE, check out this post.

I recall that I bought at 2.5 Hive per token. There was a seller listing tons of WORKERBEE for sale at 2.50 Hive about a month ago. I found that expensive, and placed a massive buy order at 2.40 Hive instead. That never got activated.

It has now shot up to 3.70 Hive per WORKERBEE. If I wanted to buy more WORKERBEE, I had to pay way more than 2.5, it seems. How happy should I be happy with the green candles?

This seems complicated, actually. Making sense of the profits and losses in the layer 2 tokens can call for some mental gymnastics.

Indeed, how do I make sense of the spike in WORKERBEE price, in the face of decreased Hive price?

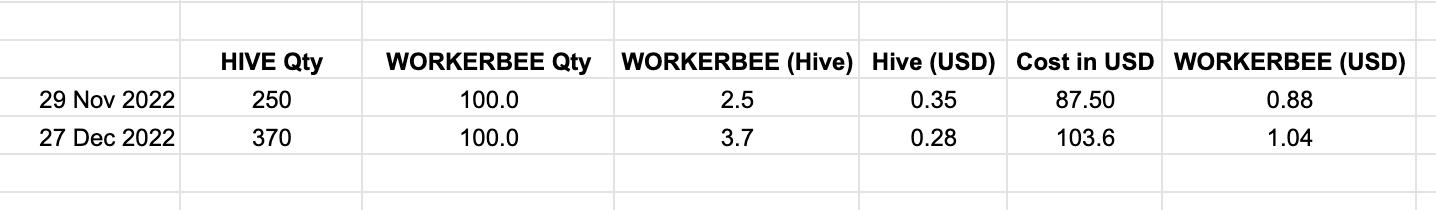

I know I had to rely on the spreadsheet to make sense of it. A calculator will do, but I prefer to use a spreadsheet. See below for the pretty output.

Now, let me walk you through it.

On 29 Nov 2022 (See row 1), when WORKERBEE costs 2.5 Hive apiece, to buy 100 WORKERBEE, it would cost 250 Hive, i.e. 100 x 2.5 = 250.

With the price of Hive going at USD 0.35 then, the cost to buy 100 WORKERBEE was USD 87.50 since I had to pay with 250 Hive (i.e. 250 * 0.35 = 87.5).

The price of WORKERBEE in USD terms becomes USD 0.88 per piece (USD 87.50 divided by 100 WORKERBEE). Note that there is rounding off in my spreadsheet calculations.

Based on the prices dated 27 Dec 2022, I have to fork out USD 103.6 to buy 100 WORKERBEE today. That is 18.5% more expensive taking the original cost of USD 87.5 as a reference.

If I am using new fiat to buy the WORKERBEE now, I will be forking out 18.5% more because I am buying them about a month later. I was originally thinking of getting more WORKERBEE, but no thanks!

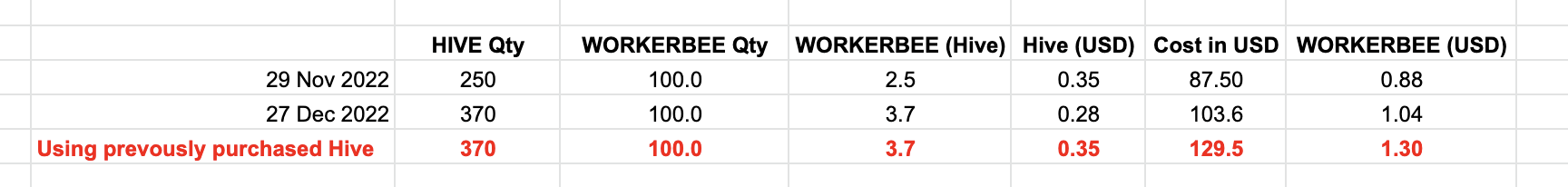

Now that we have come this far, let's check out how potentially silly would I be if I use my previously purchased Hive (at USD 0.35) to buy WORKERBEE today. That is, instead of injecting new fiat to buy WORKERBEE, I use those Hive purchased at USD 0.35 before the recent drop.

The calculation above suggests that my cost for the 100 WORKEBEE would be USD 129.5, or USD 1.30 per WORKERBEE.

This exercise taught me that it is important to do the sums when investing in layer 2 tokens. Hopefully, you learned something and replicate this for the layer 2 tokens of your choice when you want to make an investment.

It is not that difficult.

P/S: This is not financial advice, and please do your own due diligence before investing.

If you read this far... and if you are a like-minded Hiver who is on the path to learning more about Hive and crypto investing, and if you like to be tagged when I write such posts, I welcome you to leave a comment below and let me know. We can form an alliance to support each other's growth.

You might be interested in this post, @jacoalberts, @young-kedar, @svanbo and @hankanon!

Posted Using LeoFinance Beta

I ended up with all my purchases on a spreadsheet with a comparison in US Dollars. That helps me know when to sell.

yeah, that's a good practice. But I ain't so disciplined in recording every transaction. Always trigger happy when trading these L2s. I would study my LEO stash more closely next.

!PIZZA

It's pretty depressing right now when I review my spreadsheet. There's a few bright spots, but most of it's pretty dismal. I am glad to receive the payouts on card rentals, SPS, and liquidity pools, but the overall investment is way down. I think some of it like Hive will rebound, but most of the Splinterlands assets probably will not.

It is important to minimize the stakes for those that could possibly go flat or disappear, and concentrate on the more robust assets as we invest in the long term.

In my case, I just powered up my liquid Hive after calculating that my 20% target of profit from selling Hive is 0.45. I think with Hive at 0.29, 0.45 would take a long time. Might as well power it up and stack the curation rewards in the meantime. Always ready with a strategy to power down when the tide turns.

!PIZZA

I did something similar. I have a top number for HP, so any amount above that, I keep liquid or convert to HBD. I have several points where I will sell Hive. The first is $0.38, but the bulk of it is at $0.46 and $0.86, which is a long time from now!

Sheesh, that's a bummer. If you bought in at the 2.5hive you'd have made a profit in hive.. Not in usd but in hive you would have.. But then comes the question of selling when it jumped in hive or just keeping it.

Yeah, indeed. There are always opportunities. Need some strategies and systems to apply to win this game! !PIZZA

I gifted $PIZZA slices here:

@cryptothesis(6/15) tipped @djbravo (x1)

cryptothesis tipped technicalside (x1)

cryptothesis tipped jfang003 (x1)

cryptothesis tipped methodofmad (x2)

Join us in Discord!

I haven't bought WORKERBEE in a long while and you forgot to include the profit you got from the mining token (BEE). I think I bought mine back almost a year ago and the amount of Hive was lower but the fiat price was higher.

Posted Using LeoFinance Beta

Would be interesting to see how that investment fare too.

BEE seems quite stagnant and uninspiring. My earnings is meager there:

!PIZZA

Last year i have my all money in game reward token and the token goes down 90 '/'. Your strategy is to stake your tokens and earn reward. But coin prices going down because of bear market. You just hold your coins and wait for bull market.

Bull market would take a while, I think. So let the tokens do their work now is best. !PIZZA

Yeah your are right if coins perform well in bear definitely it will going up incoming bull market.