Two guarantees

Are these the only two guarantees in life...death and taxes? I'm not sure on the answer but I'm pretty sure everyone pays tax in one way or another, not just income earners.

Income tax, fringe benefits tax, capital gains tax, fees and tolls, goods and service tax, import and export tax, land tax, value added tax, carbon tax, sales tax, luxury tax, vehicle excise duty, currency transaction tax, fuel excise, stamp duty, property transfer tax, alcohol tax, cigarette tax, gift tax, dividend tax...all taxes found in various countries of the world and all legislated. There's others but I think you get the idea that paying tax is quite unavoidable.

In Australia about half the population pays income tax, just over thirteen million people, and...wait for it folks...the government has announced a tax cut for every single one of them. There's also some changes to the tax-free threshold as well further reducing income tax for some. That's right, a reduction in tax.

I'm not going to go into it all as it can be complicated, but essentially each tax payer will be taxed less (from July 1st 2024) in each pay cycle so they will receive more in their bank account on pay day. It will mean I'll be taxed about $3,300-$4,000 less per year. That's ok right? I mean, even at the lower amount, having $275 extra a month is ok, even though it's not a lot of money in Australia. Having said that, the government will make it up in some other way I'm sure.

The tax-free threshold isn't changing, currently $18,200, which means a person can earn $18,200 AUD in a year and pay no tax. For those outside Australia that's not a lot of money and one couldn't live independently on it, just so you know.

What's changing though, is the tax rate as incomes increase over various ranges above the tax-free threshold.

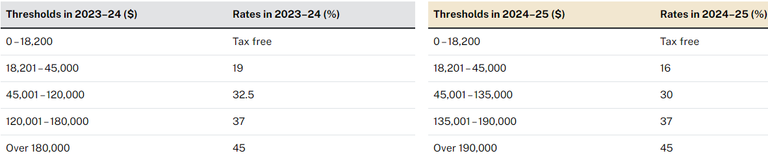

Below is a chart I lifted from the Australian Tax Office website showing the rates and thresholds.

To explain:

- $0 - $18,200 is tax free

- $18,201 - $45,000 is 16% tax (down from 19%)

- $45,001 - $120,000 is 30% tax (down from 32.5%)

Most Australians are in the $18,201 - $45,000 range but, of course, many earn much more. You'll note the higher income-thresholds have not received tax cuts although those earning at that level will benefit as they push through the lower levels of course.

I'll be honest and say that this tax cut seems a little ineffective considering the rate at which inflation rises and how costly most everyday items are becoming and that's not even considering shrinkflation - the way actual products come with lesser quantities which all have inflated prices.

Food, fuel, insurances, licensing and registration, utilities, goods and services, medical and prescriptions, entertainment, mortgage interest rates...all of these and more have skyrocketed and the tax cuts, while welcome, don't go far in the way of filling the gap; it seems a bandaid-fix designed (probably) for the government to curry favour from voters prior to the inevitable Federal Election. We'll all take it though.

I'll put my tax saving into investments (gold and silver probably) which will make the additional income work harder for me, but many will use it to (try) and plug their financial hemorrhaging, the bleeding out of their incomes, just to stay afloat day to day. (Of course, many are to blame for their own issues through overspending and credit debt, many are not though.)

Like I said, it's a complex issue and I don't want to get into it here but it was worth touching on considering I recently spoke with some people who are really struggling. Will the tax cut help? Yeah, for sure it will, but not enough.

What's it like in your country?

Yeah, I know some of you reading this may look at the figures and think, that's a lot of money, but the truth of it is that due to the cost of living here in Australia it really is not. I wonder what the tax situation in your country is and what your government is, or is not, doing to help its citizens. Feel free to comment and let me know.

Design and create your ideal life, tomorrow isn't promised - galenkp

[Original and AI free]

The money image is my own - The table image is from the ATO as stated above

Last I checked we were right around 7% inflation so a 3 percent tax cut along with a standard three percent raise still wouldn't cover most people. It's sad. Want to hear something funny though? My brother in law is an accountant who does tax audits. His best friend growing up is a mortician. Death and taxes in the flesh. Always good buddies!

Yep the same here basically, the tax break won't make much a difference to most people. Sadly, some will even use the additional money to help secure more credit. That's a slippery slope, bonkers really.

Funny that those two chaps became best friends huh?

They actually grew up down the road from each other, so probably more funny that the picked the professions they did!

Congratulations @galenkp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 91000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Interesting. Death and tax. I never thought about that. Thanks for the information. @galenkp

No worries, you're welcome.

Have a nice day ahead. ☺️ @galenkp

In America we will be facing higher taxes. For instance we get less standard deductions in 2025 federal taxes.

I'd expect that to be the case in most places which leads me to believe the government will make up for the tax break they've announced in other ways.

Just stopping by to tell you that I find all this information you've shared about taxes and salaries in your country really interesting. It's always helpful for the general knowledge that every human should have ;)

I also find it interesting to know what's going on in other countries financially, what similar items cost and all; it gives valuable perspective.

Well, I'll tell you that these days I was asked to sign my pay slip for the year. I earned 60K CUP last year, but everything here is in dollars. And the exchange rate is 1 USD X 380 CUP. Calculate... just to tell you, 30 eggs cost 3100 CUP. A box of chicken, 11000 CUP. All this in the MSMEs because the government doesn't have these products to sell.

Yeah, it's pretty crazy what people have to pay for basic items.

Here, 12 eggs is $6AUD ($4.92US) so 30 eggs is $12.30US. Australia is very costly, but we have a higher income on average too.

There's a website I found a while back that compared the same items in different countries which was fascinating to see.

Higher? I read those numbers... and well.... I think I am in extreme poverty.

This is what I earned in one year, expressed in dollars.

Yeah, bonkers really, that's $240 Australian dollars...I put that value of diesel into my truck each time I fill it up. Here's a 100% vote to help out a little.

I have long thought of writing in detail about this kind of thing. Truly, our situation is so unique and strange that it is sometimes difficult even for us to deal with it.

Extreme poverty is a figure of speech in my case because I have always managed to get by and live decently.

However, I know that there are people who may go to bed without eating and you can see how our emigration is growing. People want to see the world and not be worried about such basic things as putting a piece of bread in their mouths.

In the same way I know that in other places, the worries that we have here, the lack of food or shit wages, are other things like keeping a job almost slavishly, and even working at something you hate, paying high rents, and all the insurance and things that have to be paid for. My sister who is in the USA, for example, tells me that even laughter is paid for there.

Thank you for your concern, G.

After the annual budget review, Singapore often issues cash vouchers or payouts, such as Community Development Councils (CDC) vouchers, to redistribute wealth and support lower-income citizens. Even though it helps, as you mentioned, it is not quite sufficient given the high cost of living in Singapore! 🙃

Yeah Sinagapore is a costly place, certainly for visitors; I've been many times and always comment on the cost of things. Having said that, it's quite costly here too, money not going as far and so on, those not adjusting for it, their spending habits, are in for a wild ride into oblivion.

Yeah it is absolutely crucial for individuals to understand their spending habits and manage their finances wisely. Without careful thought and planning, things can quickly spiral out of control! 😵

Those tax cuts will definitely help, especially those having difficulty. Our highest tax bracket in the Philippines is only up to 35%, so seeing yours at 45% is surprising. We do have a different setup where a flat amount is paid, and additional will be computed based on how much higher the salary exceeds a certain threshold.

Australia is an expensive country to live in and it's getting worse...it's also unlikely the tax cuts will go far to alleviate the financial difficulties people face although some will benefit hopefully.

When reading this, I wanted to sound as if you are painting a picture to show us the we only live to pay taxes and then die. But I later discovered some other hidden truth.

Taxation is a burden everywhere and sometimes feels as if citizens shouldn't be paying taxes anymore. But if we don't how will the government develop the country?

The problem in my country is that we we live under a hyperinflated economy and then we pay too many taxes. In fact, there is this problem of many sectors and union imposing serious tax burdens on the people and the government allows the to whip us that deep. Aside from the statutory income tax, the illegal texes impose by union leaders cause the inflation to get to such high index. Because those selling commodities to us and those giving us services increase charges to cover the much taxes. The irony of this is that when one should be expected that taxes should be used for infrastructures development, these unions rather sit back and squander the money without and help in developing the infrastructures. The transport union and the market union don't even use the money to repair roads our build the markets.

Well, a little review in the taxes could be bring some more but inflation won't let the people feel the impact. Thank you for making us think in this direction this morning.

Some countries (governments) are more corrupt than others but what's generally universal is that the little people do the suffering. That's how it's always been and I'm pretty sure there's far worse ahead of us than behind. Fortunately for me I live in a reasonably affluent country and am doing ok, many are not though.

Who knows what the future will hold but for most...nothing good.

Ah!!! 😳 Let it not get worse. We are hoping for positive change. The problems we have suffered world over is already enough.

😀I just hope that things should start getting better rather than worsening (though this depends largely on the government and their policies.)

Action brings change, not hope.

Hello Galen, here in Spain we are in the middle of the income tax campaign and the data on the tax burden does not say anything good about the state administration. Here tax payments are in the European average, but compared to other countries such as Germany the data are not good: the tax burden in Germany is 10% higher than in Spain, although the average income of a German citizen is 45% higher than that of a Spaniard. And perhaps the worst thing is that this high tax collection is not preventing a steady deterioration of public services. So it is understandable that I don't pay my taxes with much joy. A hug

Taxes are always going to be a thing and they help a government run and develop the country...as long as those funds go to the right places and are not misappropriated as is so often the case. Tax is unavoidable and I don't mind paying it...but I want to see something in return you know? Infrastructure, a better health system, schools and so on; unfortunately it doesn't always occur.

I agree with what you say. I have the misfortune to visit Scandinavian countries at least a couple of times a year. This gives me the opportunity to appreciate what is done in my country with taxes and what is done in other countries. And, to be honest, I envy the use of taxes in these Nordic countries.

They do it pretty well in a few places and the Scandinavian countries are a good example.

Exactly, that's it. In some places it doesn't hurt to pay taxes.

Have a great evening; this way: lunchtime.

Well here in Spain and in Argentina where I have communication all the time, the issue of taxes is atrocious. More and more of them and higher and higher, especially for the self-employed, which means that many businesses have to close down.

Here we talk about crisis, if I compare it with Argentina it is not so serious, but in general the taxes are strangling those who have businesses.

In Argentina with the previous government it is a disaster and the current government is doing what it can to reactivate the economy.

The more taxes the more recession.... very hard topic!

Maybe we need an apocalyptic event and the total breakdown of society...that'll sort things out right? No government, the strong survive, the weak do not...like in the good old days. How do you reckon that would go?

I think it could be a solution, and I don't think that time is far away, the issue is whether it will be slow and painful for many or abrupt.

The strong and the awakened survive... I think it is so, a big collapse will come and very soon, maybe in less than a year. You are right to have reservations.

It's a good thing that the government decides to reduce the tax. Even though the impact wouldn't be much because of the inflation, yet the little effort is something.

Taxation is okay in countries where the citizenry see the impact of their taxes on infrastructural development. But in our side where we keep paying from all angles but the infrastructures keep depleting, it makes us not happy with the system.

Yeah, some countries are a cesspool of corruption.

Think about life without paying taxes for once. If there is no tax then there is no government. If there is no government, then there is no safety around us. And if there is no safety then life is not possible. So, my brother, if you have to pay taxes, some countries have high taxes, some countries have low taxes. But taxes are essential for all. Your information about taxes is very good, thank you very much for sharing it with us here. @galenkp

Yes, you state the obvious.

Income taxes in my country are very high, so employers resort to an illegal act, they pay workers illegally.

The worker thus receives a larger amount of money, the employer pays less, and the state budget is at a loss...

The worker is also at a loss, but the one who agrees to work illegally is usually forced to do such an act.

What happened to me a few years ago?

I live with my partner in the apartment where I am registered for the address of residence. When my father, the owner of the apartment where he and my mother lived, passed away, we agreed to divide the ownership of the apartment between my mother. my brother and me.

As I am registered at another address, because I cannot reside in two at the same time, I was not able to take advantage of the tax discount, and for that reason I pay tax approx. 300Hive 🙂(at the current price) more than my brother and mother.

The tax must be paid, and for the rest what is left...

The same happens here but when people get caught out it goes badly.

As I said, taxes are not avoidable and those who attempt to avoid it often pay in other ways. The punishments for tax avoidance are very high in my country.

In my country, mostly some big "businessmen", politically close to the government, cheat the most with taxes, And the government doesn't touch them, as the old saying goes: "a crow can't take out a crow's eyes". Small businessmen suffer, who hide some minor tax offense or citizenship...

Hello galenkp!

It's nice to let you know that your article will take 14th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by blind-spot

You receive 🎖 0.1 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 285 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART