Aping Into Arbitrum: Exploring The GMD Protocol Vaults

Not a hype chaser and maybe this is the reason I landed on GMX soo late! The perpetual trading platform was launched in September 2021, offering perpetual contract trading with up to 50x leverage.

GMX doesn't trade tokens, as users will deposit collateral to take long or short positions. The traders will be paid in USDC as settlement profit for shorts or the pair token for longs. It was thanks to GMX that I got to explore the GMD Protocol Vaults, end engage with DeFi at high efficiency!

GMD Protocol Vaults

The GMD Protocol Vaults were my newest DeFi experiment on Arbitrum, a platform for maximizing yields and aggregating data built on top of already existing software. The GMD’s initial offerings are a set of GMX and GLP-based single-stake vaults for $BTC, $ETH and $USDC, with no risk of impermanent losses.

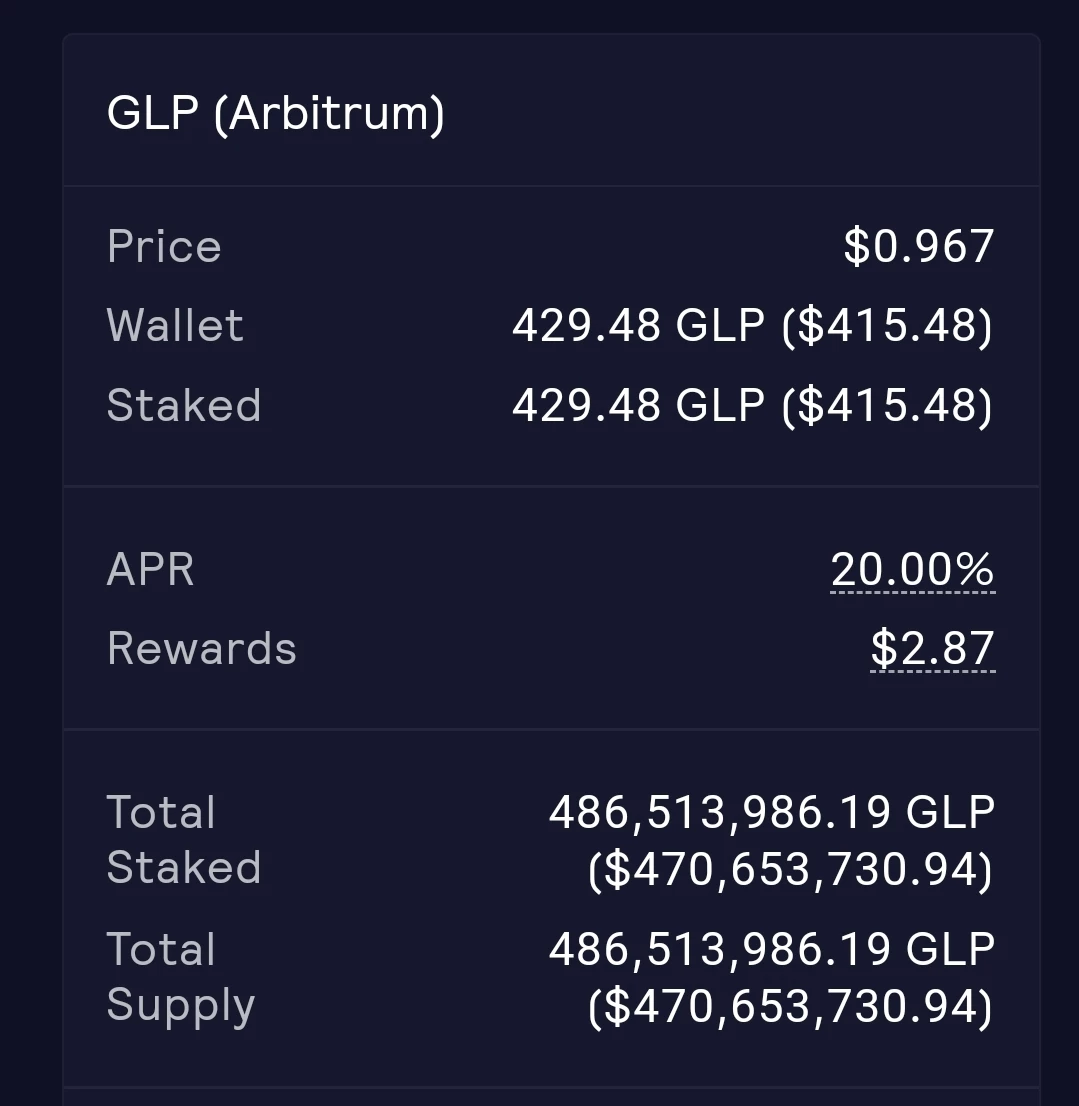

The GMX perpetual trading platform was launched in September 2021, allowing users to deposit collateral and take long or short positions. The GLP index is made up from the assets used for swaps and trading with leverage. The fee depends on the liquidity pool demand, being cheaper to buy GLP with index assets that are demanded by the market but are underrepresented in the pool.

GMD uses either delta-neutral or pseudo-delta-neutral strategies to aggregate returns from an index pooling or an LP to its constituent holdings. I have no idea what that means and don't have the brain cells to understand it. They say the strategy is removing the risks of temporary loss or exposure to unsuitable assets, and this is good enough for me.

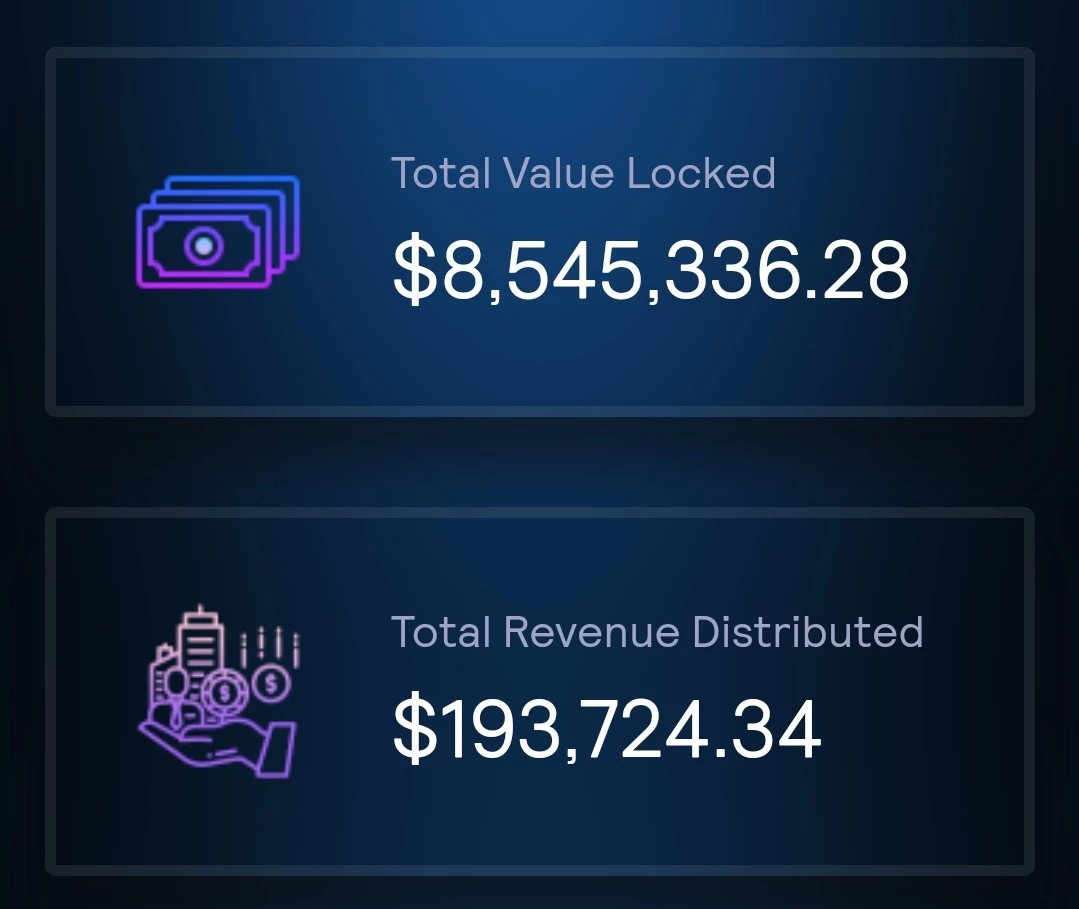

The GMD Protocol TVL was above 8.5 million USD, with nearly 200,000 USD total revenue distributed. I had to force my brain cells to understand how the GMD vaults are working!

I got the basic idea, as each asset will be used to create new $GLP tokens and generate income from the sale. Then the protocol will rebalance the composition every week, regardless of market fluctuations, and the profit will be compounded.

The vaults position are 100% liquid and the LP providers will have the assets appreciate in value against the underlying assets at APY rate. All the above sounds amazing, as the single stake in $USDC, $ETH or $BTC will aggregate yields from $GLP

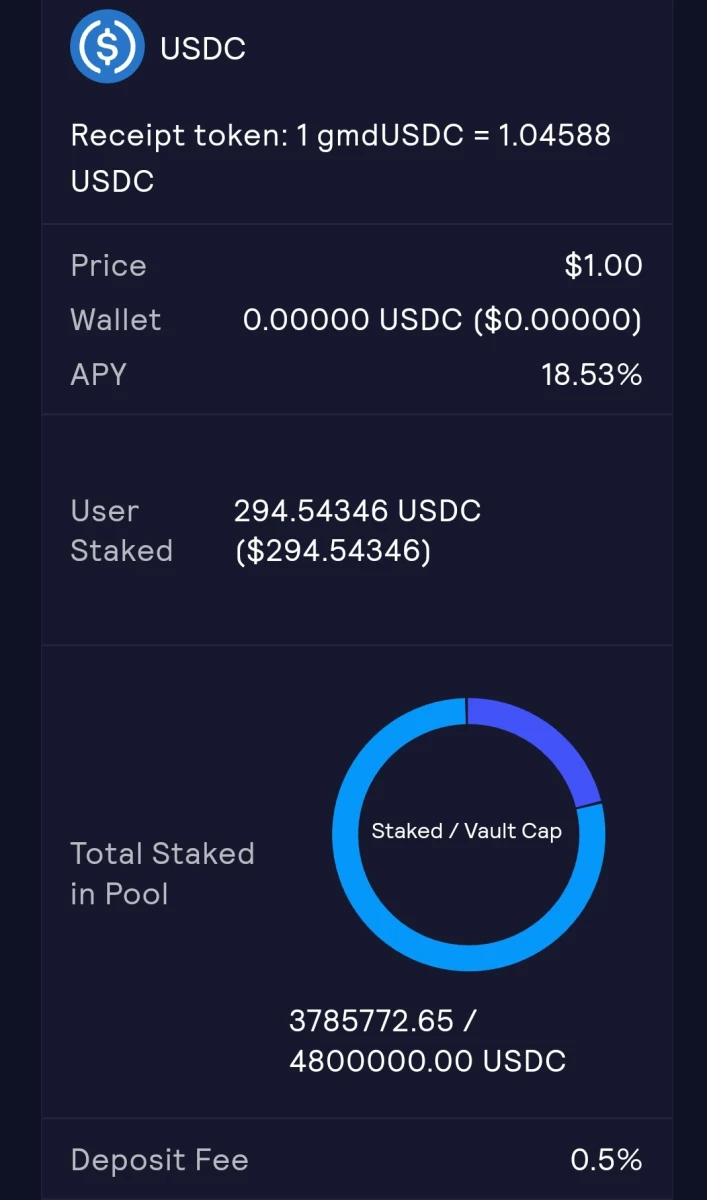

I love single stake as I can add the assets and let the auto-compounding do the job, earning real yield from the platform's revenue. The deposit fee is 0.5% of the total crypto value, higher then other DeFi vaults I used in the past. However, the 18.53% APY on USDC will cover the fee in few days.

Added all my USDC into the stablecoin vault, which was 75% full when I staked. I made a screenshot to remember my entry value and set a reminder in 7 days.

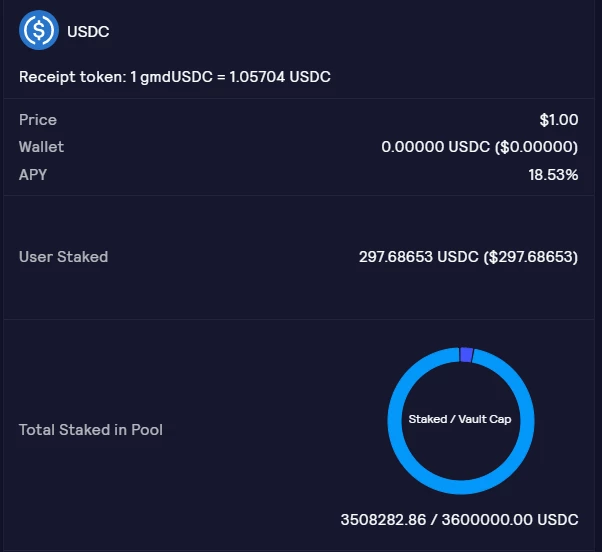

Back to Arbitrum after a week and the APY was at the same value, and the pool was almost full. I was right that the 0.5% fee will be covered quickly at 18.53%, as my current value was 297.68% USDC. I farmed 3 USDC in 7 days ... it's not much but is honest work.

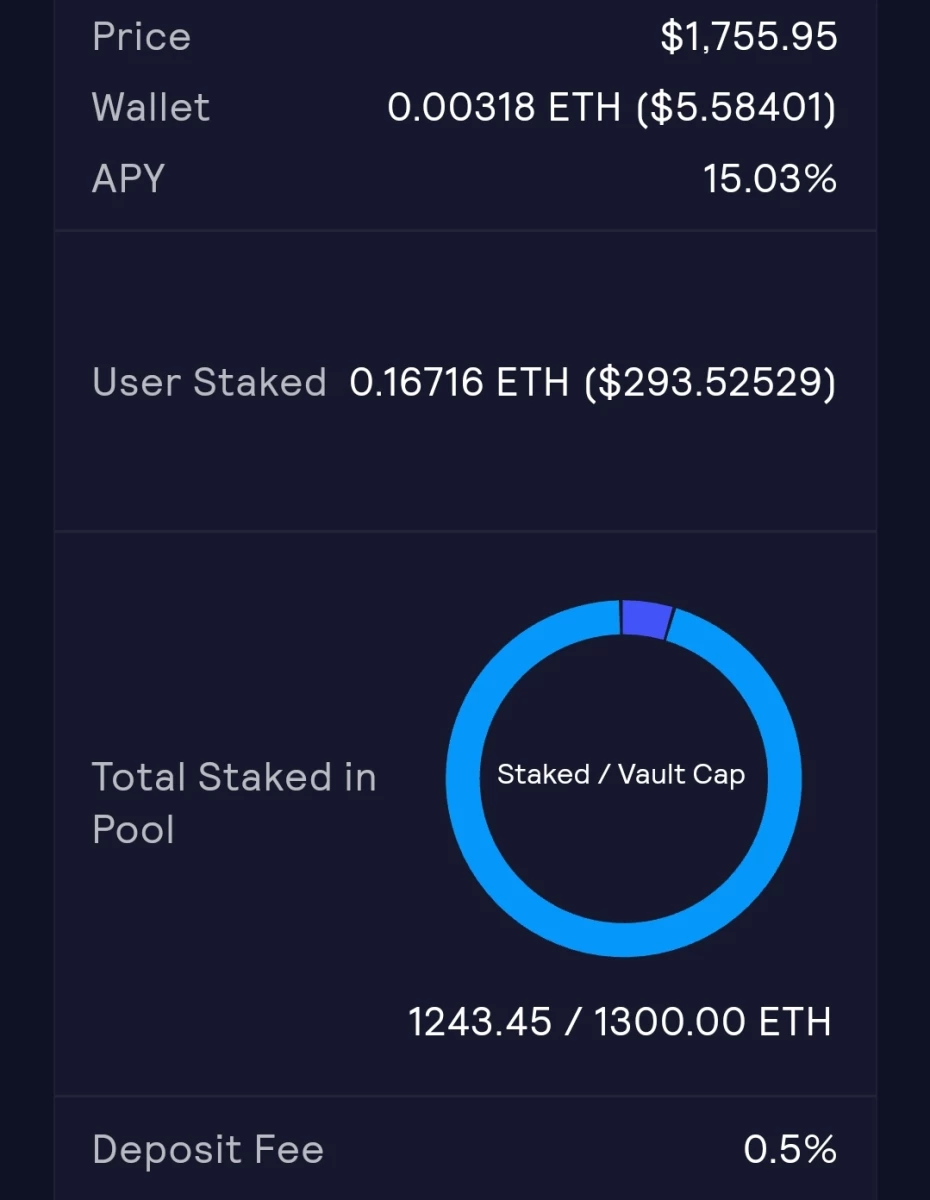

The stablecoin experiment made me try another GMD product, the ETH vault. I transferred the $ETH from mainnet, using the Across bridge for maximal efficiency and claimed $2.87 in ETH that I farmed with my GLP tokens.

The ETH Vault was almost full when I staked, hoping to recover the 0.5% fee ASAP. I staked 0.167 ETH and started gaining auto-compounding rewards at 15% APY, helping me to break even after 3 days.

Done the same weekly reminder and checked after seven days. One week of GMD farming added 0.0013 ETH, approximately $2.5 in profit, and more ETH on the long run. I can only imagine how the whales are playing with this insane APY!

Residual Income:

Play2Earn: Upland / Splinterlands / ++Doctor Who Worlds Apart++

Get Plutus Card - 3% cashback on everything + Perks

CEXs and DEXs: OKX / Biswap / Binance / Crypto.com /

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, Hive/Leo, readcash, LBRY & Presearch

Mega boost !LUV !BEER !ALIVE !PGM !LOL !PIZZA !SLOTH

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@pvmihalache! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @heruvim1978. (5/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

Thank you! !LUV !SLOTH !PIZZA

Learn more about the SLOTHBUZZ Token at Sloth.Buzz and consider sharing your post there or using the #slothbuzz next time

(3/3)

@heruvim1978, @pvmihalache(3/4) sent you LUV. | discord | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoAcross is the best, right?

Mega boost !LUV !BEER !ALIVE !PGM !LOL !PIZZA !SLOTH

@susieisclever! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @heruvim1978. (6/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

Post voted 100% for the hiro.guita project. Keep up the good work.

New manual curation account for Leofinance and Cent

Thank you! !LUV !PIZZA !SLOTH

@hiro.guita, @pvmihalache(2/4) sent you LUV. | discord | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoLearn more about the SLOTHBUZZ Token at Sloth.Buzz and consider sharing your post there or using the #slothbuzz next time

(1/3)

Nice blog

$PIZZA slices delivered:

@pvmihalache(3/5) tipped @heruvim1978

heruvim1978 tipped susieisclever

pvmihalache tipped hiro.guita