CTPSB the perfect solution for reward pools

For some time, the CTPSB token has been chosen as a reward token for the Liotes diesel pool LEN:LENM. When people provide liquidity to this pool, in addition to other tokens, they get CTPSB tokens as daily rewards. CTPSB is probably one of the best possible solutions for exactly this purpose.

Growing token value

The CTPSB token is backed by the hive power on the account @ctpsb. The amount of hive power on this account is growing thanks to the organic staking rewards, thanks to curation and post rewards. This means that to value of the token is growing constantly and thereby the token value is doing the same. Thanks to a new mechanism, we have managed to include a burning process where tokens are burnt every week. The token value is defined by the hive power on the account divided by the number of tokens in circulation. This means that the token value increase with the growing hive power on the @ctpsb account or by reducing the number of tokens in circulation. By doing both, we actually manage to have a higher growth rate than a normal hive account would. On average, the token value increases by 16% APR.

A market maker makes sure to reproduce this token value on the market and we can see a very linear progression of the market price of CTPSB.

Why it is a great solution as rewards in liquidity pools

The probleme with liquidity pools is that rewards decrease when the liquidity increases. If you put a static amount of rewards in the reward pool, this means that over time APR in the pool will go down. However, if instead of putting a static coin into the reward pool, you put CTPSB tokens, the value of the rewards will organically grow over time. If the liquidity increase is below 16% per year, this means that the rewards in the pool grow faster than the increase of liquidity and thereby the APR in the reward pool will actually go up!

Thanks to the CTPSB tokens in the reward pool LEN:LENM, the APR in this pool has remained stable for the whole year. This is a big plus for investors when it comes to decide where they want to provide liquidity...

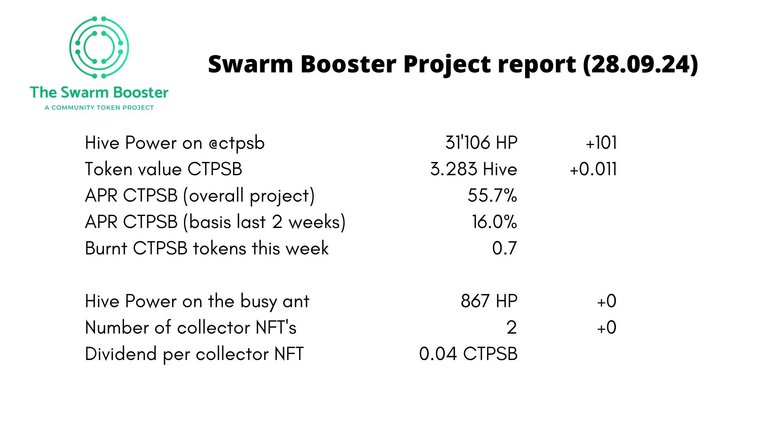

The numbers of this week

Learn more about the CTP Swarm Booster:

It really is a very efficient solution!

!PIZZA

It's really a very appropriate solution for liquidity reward pools.

thanks for the clarification.

burning the ctpsb earned via Len:lenm pool, is a good way to reduce tokens (however small) in circulation and also improve price

!PIZZA

So far, we have been able to burn a small amount of tokens like that but it makes a difference for the return and the price.

It's an interesting way to balance the APR. I haven't deposited much there but I do think my LEN tokens have added up lately. I haven't done anything with it so I might have to add it to the pool later.

When adding value to the reward pool, indirectly it is giving value to the token as such. It gets an interesting use case where you can get an nice reward by staking the token in a liquidity pool. This increases demand for the token. If the price goes up, then the APR for staking LENM goes up as well. It's working quite well I believe :-)

very nice idea

It works pretty well actually. With the LEN:LENM pool APR was stable and went even up a bit over the year thanks to the CTPSB in the reward pool.

$PIZZA slices delivered:

@imfarhad(1/5) tipped @ctpsb

yeckingo1 tipped ctpsb